What is Annual Contract Value (ACV) and How to Calculate It?

By Prosanjit Dhar

April 18, 2025

Last Modified: December 24, 2025

Annual Contract Value (ACV) is an essential metric for our subscription-based businesses that shows the average value of a customer’s contract over one year.

Moreover, it equips you with valuable insights into revenue patterns, customer acquisition strategies, and overall business health.

This guide will explain you what ACV is, how to calculate it, and why it matters for your business growth.

What is Annual Contract Value (ACV)?

Annual Contract Value (ACV) is the average yearly revenue earned from a customer contract, excluding any additional fees. For example, if a customer signs a 5-year contract worth $100,000, the ACV would be $20,000 per year.

It’s a standardized metric that allows businesses to compare contracts of different lengths and values on an equal footing by normalizing them to a single year.

ACV is particularly significant for:

- SaaS companies and subscription businesses.

- Enterprise sales teams with varying contract lengths.

- Financial modeling and forecasting.

- Investor presentations and valuation discussions.

- Sales strategy development and optimization.

It provides a clearer picture of recurring revenue generation and helps standardize revenue reporting across diverse customer contracts.

How to calculate ACV in sales?

Calculating ACV is relatively straightforward, but it’s important to use a consistent methodology across your organization.

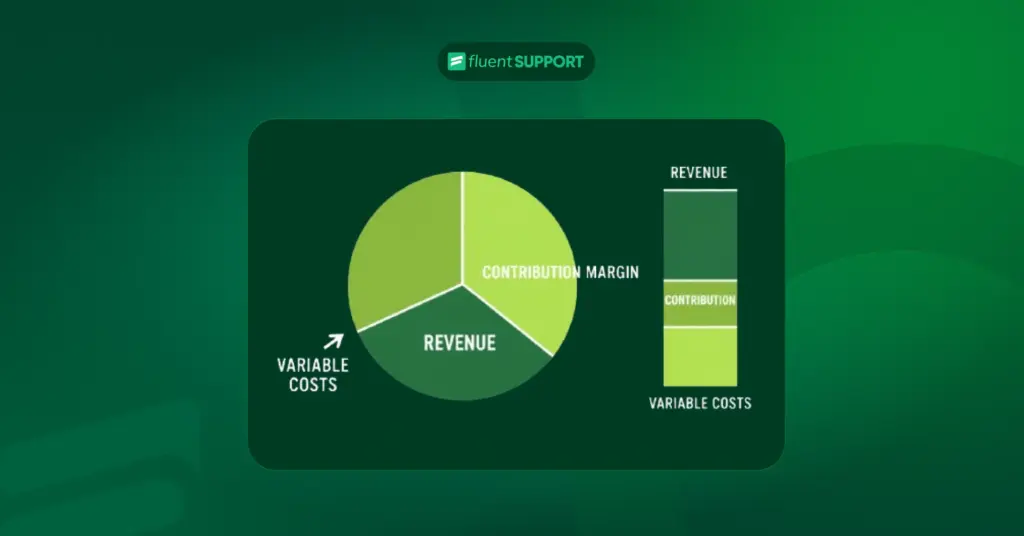

The basic formula of ACV:

ACV = Total Contract Value ÷ Number of Years in the Contract

For subscription-based businesses, the calculation typically includes:

ACV = (Subscription Fee + One-time Fees) ÷ Contract Duration in Years

When calculating ACV, remember these key points:

- Include all recurring revenue components (subscription fees, maintenance fees).

- Include one-time payments (setup fees, implementation costs) that are part of the initial contract.

- Exclude renewal fees or upsells that weren’t part of the original contract.

- Convert the contract duration to years (e.g., a 6-month contract = 0.5 years).

ACV formula in different sales examples

Let’s analyze the formula for ACV and its relation to other SaaS metrics.

Example 1: For a simple 1-year contract

Imagine a customer who pays you $60,000 for a one-year service contract. They also pay a $5,000 setup fee that’s just a one-time payment.

To find the ACV, we:

So the ACV is $55,000. This represents the recurring annual revenue from this customer.

Example 2: For a multi-year contract

Now imagine a customer signs up for 3 years, paying a total of $180,000 for those three years, plus a $10,000 implementation fee paid once at the beginning.

To calculate ACV:

The ACV is $56,667. This tells you that on an annual basis, this 3-year contract is worth $56,667 per year.

Example 3: For a short contract (less than a year)

Here, a customer signs a 6-month contract worth $30,000 with no one-time fees.

To calculate ACV:

The ACV is $60,000. This means if the contract were extended to a full year at the same rate, it would be worth $60,000.

Example 4: Company-wide average ACV

This is slightly different! It calculates the average ACV across all your customers:

This tells you that, on average, each customer brings in $50,000 of annual recurring revenue.

What’s the difference between ACV and ARR?

While ACV and Annual Recurring Revenue (ARR) may seem similar, they serve different purposes and are calculated differently:

| Annual Contract Value (ACV ) | Annual Recurring Revenue (ARR) |

| Measures the annual value of a contract | Measures recurring revenue components annually |

| Includes one-time fees | Excludes one-time fees |

| Normalized per year for multi-year deals | Focused on recurring revenue run rate |

| Used to understand the average deal size | Used to predict future revenue |

| Particularly useful for sales teams | Particularly valuable for investors and financial planning |

The key distinction is that ACV provides insight into the average value of contracts, while ARR focuses specifically on recurring revenue that can be expected year after year.

ARR example:

To better understand the difference between ACV and ARR, let’s look at an ARR calculation example using the same scenario from our first ACV example:

Company ‘A’ signs up for your software service with the following terms:

Monthly subscription: $2,000

One-time implementation fee: $6,000

Contract duration: 2 years

The ARR calculation would be:

ARR = Monthly Recurring Revenue × 12 = $2,000 × 12 = $24,000

Notice that the ARR ($24,000) is lower than the ACV ($27,000) because ARR excludes the one-time implementation fee of $6,000 that was factored into the ACV calculation.

Calculate RICE & Rank Projects Based on Priority

Why does ACV matter in our business?

Annual Contract Value (ACV) serves as a fundamental metric in subscription and contract-based businesses for several important reasons:

1. Standardized comparison framework

ACV creates a common language for evaluating contracts of different durations, payment structures, and complexity.

By normalizing everything to an annual basis, you can directly compare a 6-month contract to a 3-year contract to understand their relative value. This standardization is essential for making fair assessments across your entire customer portfolio.

2. Strategic decision making

With accurate ACV calculations, businesses can make better-informed decisions about where to allocate resources.

For example, if you discover that enterprise customers have an ACV of $120,000 while small business customers average only $15,000! You might decide to shift your sales and marketing efforts toward the enterprise segment for higher returns on investment.

3. Sales performance evaluation

Furthermore, ACV provides a clearer picture of sales performance than simply counting deals or tracking total contract value.

A salesperson who closes ten contracts with an average ACV of $75,000 is generating more sustainable value than someone closing fifteen contracts with an average ACV of $30,000, even though the second person has more “wins” on paper.

4. Business forecasting and valuation

Since it focuses on recurring revenue (by excluding one-time fees), it gives a clearer picture of sustainable income.

Investors also closely watch ACV trends when valuing subscription-based companies, as it indicates the company’s ability to generate predictable future revenue.

5. Customer success prioritization

Also, understanding which customers represent the highest ACV helps customer success teams prioritize their efforts.

Higher ACV customers typically warrant more attention and resources to ensure their satisfaction and reduce churn risk.

6. Growth trend analysis

Lastly, tracking ACV over time reveals important business health indicators. If your average ACV increases quarter over quarter, it suggests a shift toward more valuable customers.

Conversely, declining ACV might signal pricing pressure or an inability to retain high-value clients.

By optimizing your ACV

You can build a more predictable, sustainable subscription business with healthy unit economics and strong growth potential.

The reason for aligning your sales, marketing, product, and customer success strategies with the ACV profile is to maximize both acquisition and retention. So, don’t wait, start your calculation now!

Start off with a powerful ticketing system that delivers smooth collaboration right out of the box.

Leave a Reply