What Is Contribution Margin? Definition, Formula, and Example

By Uttam Kumar Dash

January 29, 2026

Last Modified: January 29, 2026

Each product you sell tells you two facts. It shows what it costs to produce and what it gives back to your business. Contribution margin is that difference. It is the cash left from a sale that pays overhead and builds profit.

Learn this number, and you will see which products support growth and which drain resources.

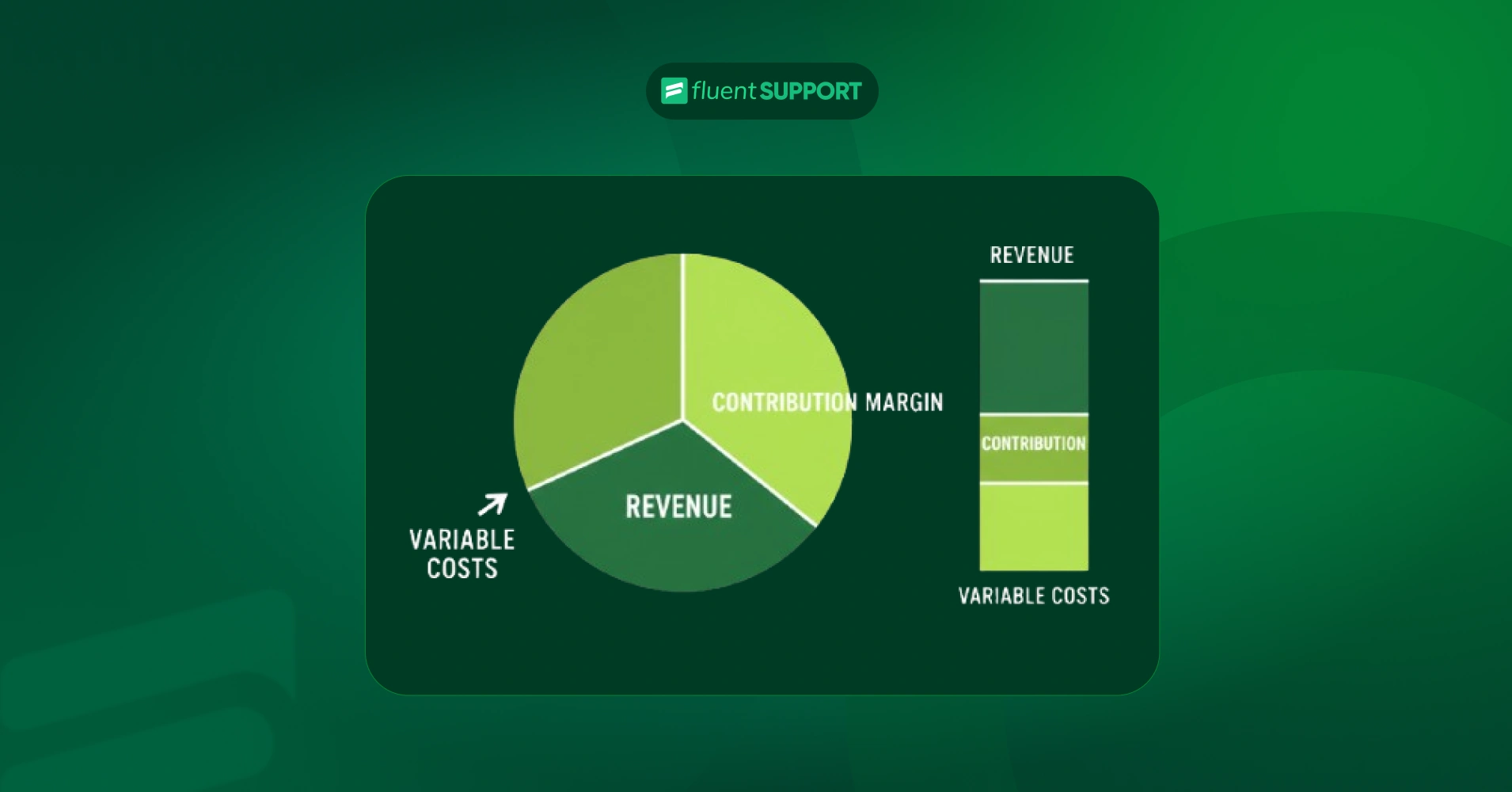

What is contribution margin?

Contribution margin measures product profit after you pay variable costs. Variable costs change with each sale. These include raw materials, shipping, sales commissions, and production labor.

The amount left goes toward fixed costs such as rent, software, insurance, and salaries.

This metric separates each sale from your full cost structure. A positive margin means the product helps pay bills and produce profit. A negative margin means you lose money on every unit.

Real life rarely matches textbook math. Variable costs shift often. Shipping fees change by weight and distance. Card processors charge different rates. Ad prices move each day.

Fixed costs shift too. A growing firm hires staff, rents larger space, or buys new systems. Costs jump in steps instead of staying flat.

Contribution margin formula

Formula

You can calculate contribution margin in two ways.

Total contribution margin:

Contribution Margin = Total Sales Revenue − Total Variable Costs

Per unit contribution margin:

Contribution Margin per Unit = Selling Price per Unit − Variable Cost per Unit

Picture a store that sells coffee mugs for $25. Each mug costs $10 to produce and ship. The contribution margin is $15 per mug.

Own your eCommerce Store Forever

Contribution margin ratio

The ratio shows margin as a percentage. It helps you compare products fast.

Formula:

Contribution Margin Ratio = (Contribution Margin ÷ Sales Revenue) × 100

Using the mug example:

($15 ÷ $25) × 100 = 60%

Sixty cents from each sales dollar goes to fixed costs and profit.

Example

A software firm sells a subscription for $100. Variable costs total $15. Payment processing costs $3. Customer support costs $7. Server usage costs $5.

- Contribution margin: $85

- Contribution margin ratio: 85%

Sell 500 subscriptions in a month, and total contribution margin reaches $42,500.

What contribution margin tells you

Contribution margin shows how each sale affects profit. It guides daily and long-term decisions.

- Your profit limit

Net profit margin never rises above contribution margin. A firm with a 30% contribution margin will post a lower operating margin after fixed costs. This sets clear expectations. - Warning signal

Zero or negative margin points to a broken model. Raise prices. Cut production costs. Reduce fulfillment expenses. Act fast. - Clear sales impact

After you cover fixed costs, each extra sale adds its full margin to profit. This makes the metric useful for judging promotions and discount campaigns. - Smarter resource use

A product that sells in high volume but earns little per unit can trail a lower-volume product with stronger margins. Direct your effort toward the stronger return.

What Is a good contribution margin?

A good margin depends on the industry. Capital heavy firms often post higher margins. Labor heavy services run lower margins. Many firms view ratios above 50% as strong. Retail businesses often succeed near 30%. Software companies often target 80% or more.

The core rule is simple. Margin must cover fixed costs and still leave room for profit. Negative margins need fast correction.

Contribution margin vs profit margin

Contribution margin looks only at variable costs. It shows how products support overhead. This makes it useful for pricing and product choices. Profit margin includes every expense. It shows the share of revenue that turns into real profit.

A product can post a 70% contribution margin. The firm may still report a 10% profit margin. Fixed costs create the gap. Use contribution margin to guide product decisions. Use profit margin to judge the full business performance.

How to improve contribution margin

- Raise prices

Small price increases lift margin fast. Test customer response before broad changes. - Cut variable costs

Negotiate supplier rates. Reduce waste. Pick lower-cost materials that meet quality standards. - Refine product mix

Promote high-margin products. Remove weak performers unless they support a larger strategy. - Increase production control

Tight processes lower the cost per unit. Technology often trims manual work and error rates.

Contribution Margin and Break-Even Point

Contribution margin helps you find the break-even point. This is where revenue equals total cost.

Break-Even Formulas:

Break-Even (Units) = Fixed Costs ÷ Contribution Margin per Unit

Break-Even (Sales) = Fixed Costs ÷ Contribution Margin Ratio

Example: A bakery carries $15,000 in monthly fixed costs. Each cake sells for $50. Variable cost per cake is $20. Contribution margin equals $30.

Break-even volume equals: $15,000 ÷ $30 = 500 cakes per month.

Set a profit goal of $6,000, and the math shifts: ($15,000 + $6,000) ÷ $30 = 700 cakes.

Wrap up

Contribution margin brings product economics into focus. It shows what each sale adds after variable costs. Track it often. Pair it with profit metrics. Strong numbers support stable growth and clearer pricing choices.

FAQs

Here are some of the most common questions we receive. If you do not find what you need, check our documentation or contact us.

Start off with a powerful ticketing system that delivers smooth collaboration right out of the box.

Leave a Reply