Revenue vs. Sales: What’s the Difference?

In the realm of business wonks, terms like “revenue” and “sales” are often thrown around haphazardly. But the truth is, they carry distinct meanings that can significantly impact how we perceive a company’s financial health.

So let’s get this straightened out for good.

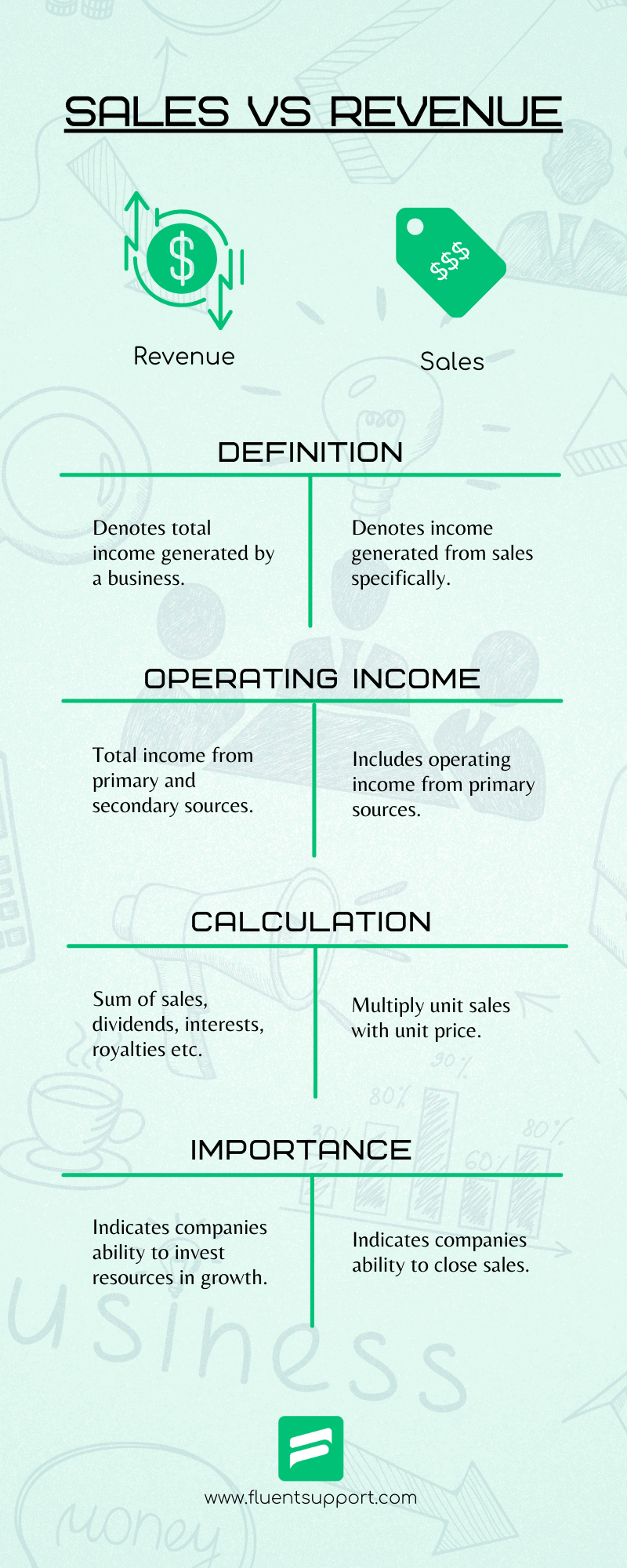

What makes revenue and sales different

On the surface, revenue and sales might seem the same— I mean, they both involve money flowing into a business, right? Well, not quite.

In fact, that’s the most common confusion people have when it comes to sales and revenue.

Sales, in its simplest form, represent the number of products or services a company sells. It’s the millennia-old act of exchanging goods for money. For instance, if your online store sells 100 widgets, your sales for that period amount to 100 units.

On the other hand, revenue casts a much broader net. It consists not just of direct sales but also of other income streams a company might have. Revenue includes not only the money generated from selling products (i.e. the sales revenue) but also income from subscriptions, licensing fees, and even interest on investments and loans, etc.

Revenue reflects the total income a business earns. It offers a more comprehensive view of the financial landscape.

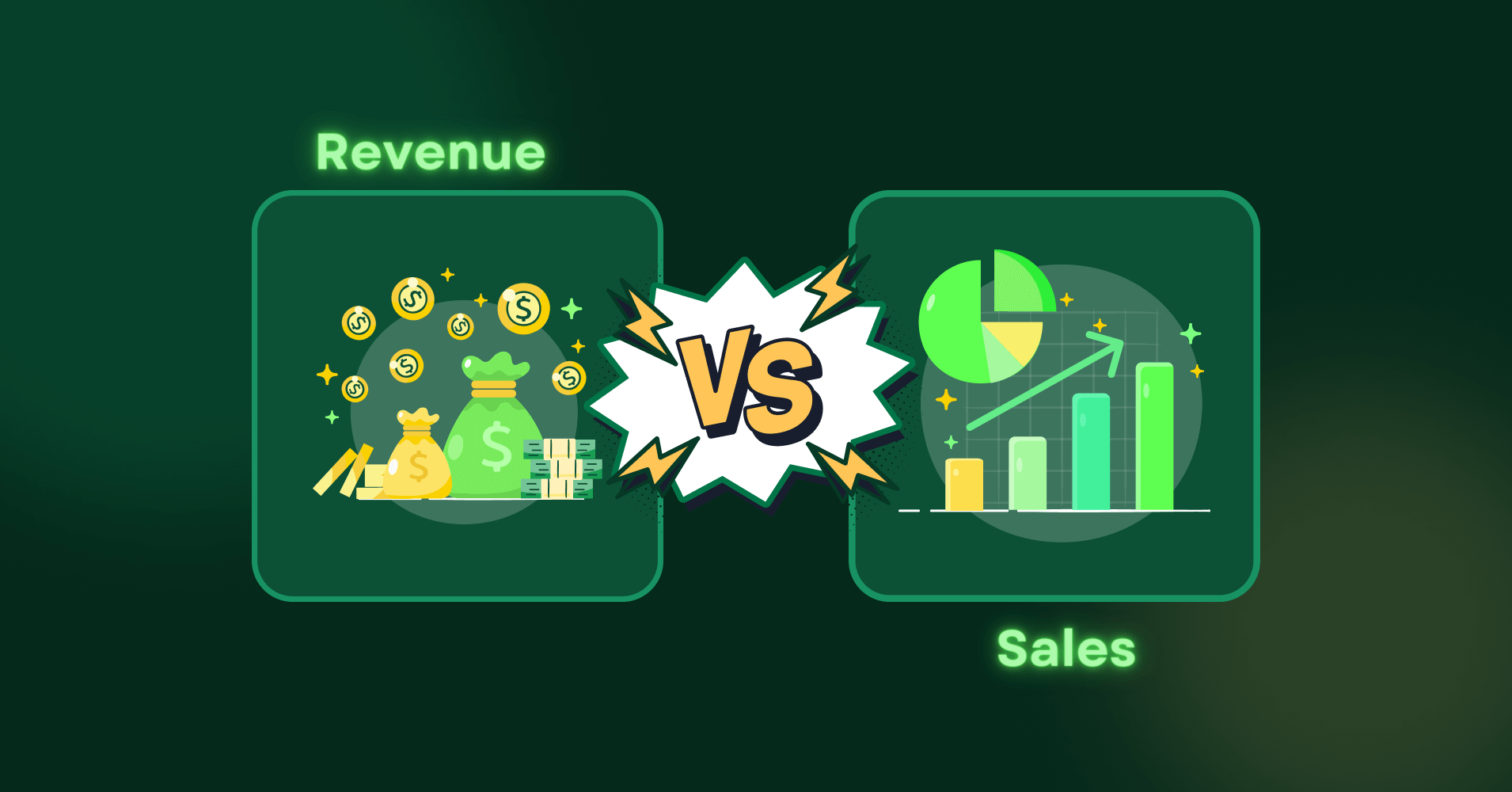

Sales vs. Revenue Compared

Let’s break it down with a hypothetical scenario. Imagine you run a software company. Your primary product is a cutting-edge app, bringing in a substantial portion of your revenue.

However, you also license your technology to other businesses for a fee and earn interest from investments. While your sales focus on selling the app itself, your revenue encompasses the sales, licensing fees, and interest income—a more holistic measure of your company’s financial status.

Take Tesla’s first-quarter report for 2021 as a prime example of how gross revenue extends beyond the mere sales of its EV’s. While Tesla reported a noteworthy net income of $438 million for the quarter, the spotlight was on its impressive $10.4 billion in revenue.Crucially, Tesla’s gross revenue outpaced its total sales, and here’s why.

Beyond the core business of selling electric cars, Tesla diversified its income streams. In this particular quarter, the company earned $518 million by selling emissions credits to other automakers, showcasing how non-sales factors significantly contribute to overall revenue.

Similarly, examining Exxon Mobil Corporation’s financial data for the quarter ending June 30, 2019, provides valuable insights into the distinction between revenue and sales.

In June 2019, sales and operating revenues amounted to approximately $67.5 billion, reflecting a decrease from the $71.5 billion reported in June 2018. However, total revenue for the same quarter in 2019 was $69 billion, compared to $73.5 billion in 2018.

This discrepancy highlights the inclusion of additional revenue sources beyond direct sales in the total revenue figure. Notably, for Exxon Mobil, revenues from other sources, such as equity affiliates, contributed significantly, totaling over $1.5 billion in 2019 and $2 billion in 2018.

Wrapping up: The Bottom Line

In conclusion, while sales are a vital component of revenue, the two are nowhere near the same. Understanding the difference between revenue and sales is pivotal for businesses as is sales and service aiming to evaluate their financial performance accurately.

So, the next time you’re assessing a company’s health, look beyond the sales figures. Delve into the broader picture painted by its total revenue, and you’ll gain a more nuanced understanding of its financial soundness.

Leave a Reply