Customer Profitability Analysis: Definition, Formula, Benefits

Businesses need all sorts of data to evaluate the performance of individual teams as well as the business as a whole. One such metric is the customer lifetime value (LTV), which we’ve already talked about. However, it’s not a comprehensive metric. This is why more and more businesses are switching to a customer profitability analysis model.

In this article, we’ll check out what profitability analysis means, why you should track it, and the best strategies to maximize the profitability of your business.

What is customer profitability analysis

First off, customer profitability is the measure of profit a customer is expected to generate through the course of doing business with you. From a managerial perspective, customer profitability is the alternative to product line profitability, which only denotes profit from individual products.

According to the concept of CPA, any customer that generates a revenue stream larger than the expenses spent on acquisition, sales and service is a profitable customer. Analyzing customer profitability tells businesses where their revenue is coming from, and which customers are drawing it down.

Difference between LTV and Customer Profitability

While LTV also measures a customer’s prospective value over the whole period of engaging with a business, it’s not the same as profitability analysis.

The key difference between LTV and CPA are,

Revenue vs. Profit; LTV measures the overall revenue a customer generates over the course of doing business with you. On the other hand, CPA measures the exact profit a customer is going to provide.

Touchpoints; While LTV measures key touchpoints to assess the value, it doesn’t cover all touch points. CPA is different because it takes into account all the touchpoints involved, from lead marketing to after-sales.

These key differences make CPA a much more actionable metric compared to LTV.

Why undertake profitability analysis

Conducting profitability analysis helps businesses make informed decisions. This, in part, has a huge impact on the overall business strategy. The most concrete benefits of analyzing customer profitability are,

Downsize cost factors

A great deal in CPA is segmenting customers based on the profit they are generating. You can easily segment groups based on whether they are generating an acceptable amount of revenue against the investment you’re making for them.

It is worth mentioning that it’s okay to provide service to segments that generate low returns. However, it’s also important to monitor segments that have a negative profit index. The best course is to cut off the service to these segments because they are incurring losses even when they are doing business with you.

Marketing to the right segment

Similar to segmenting based on profit, CPA lets you segment customers based on the investment it takes to acquire them. It could easily be that the segment you’re considering as the target could be the segment that brings in the least profit. Whereas a segment that is neglected is bringing in more profit.

CPA makes drawing these lines easier and lets you drive your resources to the most effective segment. In most cases, that means you can redirect your marketing effort and resources to segments that generate the most revenue.

Customized retention strategy

Once the profit segments are established, companies can focus on their retention strategies for each group. The highest profitability customers are the place to invest in, and companies can afford to give a service of the highest quality. CPA also lets you strategize on a micro level by answering questions such as,

- What customer engagement model to choose from?

- How many CSMs are required for a specific group of customers?

Through CPA, you can get a clear margin of how much you can spend on building customer loyalty. It’s easier to design loyalty programs based on the profit margin for a customer segment.

Customer Profitability Formula

To calculate CPA, you need concise and reliable data. The formula goes as follows,

CPA = (Annual profit) x (no. of years customer stays with the company)

To calculate, you’ll need the annual profit per customer, which is calculated as follows,

Annual profit = (Total revenue generated in a year) – (Total expenses incurred in a year)

When calculating the total revenue, you need to gather data from the following sources,

Cost of customer service

Expenses in loyalty perks; Costs you incur from offering discounts and other loyalty programs.

Operational cost; Operations cost per customer

Maintaining a customer support and service team; Cost incurred to maintain a dedicated support and service team.

Recurring revenue

Upgrades to the higher plans; Increased revenue from moving to higher plans.

Cross-buying relevant products; Partial increase in revenue from cross/upsell campaigns.

The Steps in Customer Profitability Analysis

In this section, we’ll cover what you need to run a CPA and how you can analyze it for actionable decision making

Evaluate Customer costs

Customer costs are all expenses you have to spend to continue doing business with a customer. This is one of the fundamental data points you need to conduct a customer profitability analysis. Apart from the cost of production, Gross and Net sales, customers incur additional costs, such as,

Marketing costs; Also known as customer acquisition costs or CAC.

Shipping costs; Applicable for online businesses, with return policies.

Social Media touchpoint; To keep your social channels accessible at all times for customers.

Service and Support; All costs incurred when serving a single interaction with your support/service team. Also known as, customer support costs.

Define your customer groups

We’ve already covered an example of segmenting customers based on profitability. But you need to have the segments in your customer pool to make the CPA concise. Even if you don’t have access to big data sets about your customers, you can always go back to the basics.

You segment your customers based on demographic and geographic data to get started. However, the most effective customer segmentation comes from an RFM analysis.

RFM analysis is basically a weighted Recency, Frequency, and Monetary analysis of your customers. This means you can create segments based on,

- How recently they purchased from you

- How frequently they’ve purchased from you

- How much they’ve spent

Segmenting customers based on these factors help to identify who are your most valuable customers and where to invest the most.

Find the data

When conducting a customer profitability analysis, the most challenging part is conjuring the data needed to make the analysis accurate. As the formula suggests, underestimating certain costs can significantly alter the results of your analysis.

One thing’s for sure; you’ll need to get in touch with most of the departments in your business to gather all the relevant data.

For instance, customer support costs and acquisition costs, although metrics themselves are based on hard data such as cost per ticket, average handling time, and more. To get this data effectively, it’s good to invest in tools that offer detailed reports.

Applying the customer profitability analysis model

Lastly, it’s time to develop a model for your CPA and plug in the data you got from your business. For this, we’ll use an example,

Say you’ve got two segments of customers. Segment A is individual clients as such in B2C models. Segment B is SMEs that fall on the B2B side of things. For this example, consider the following data

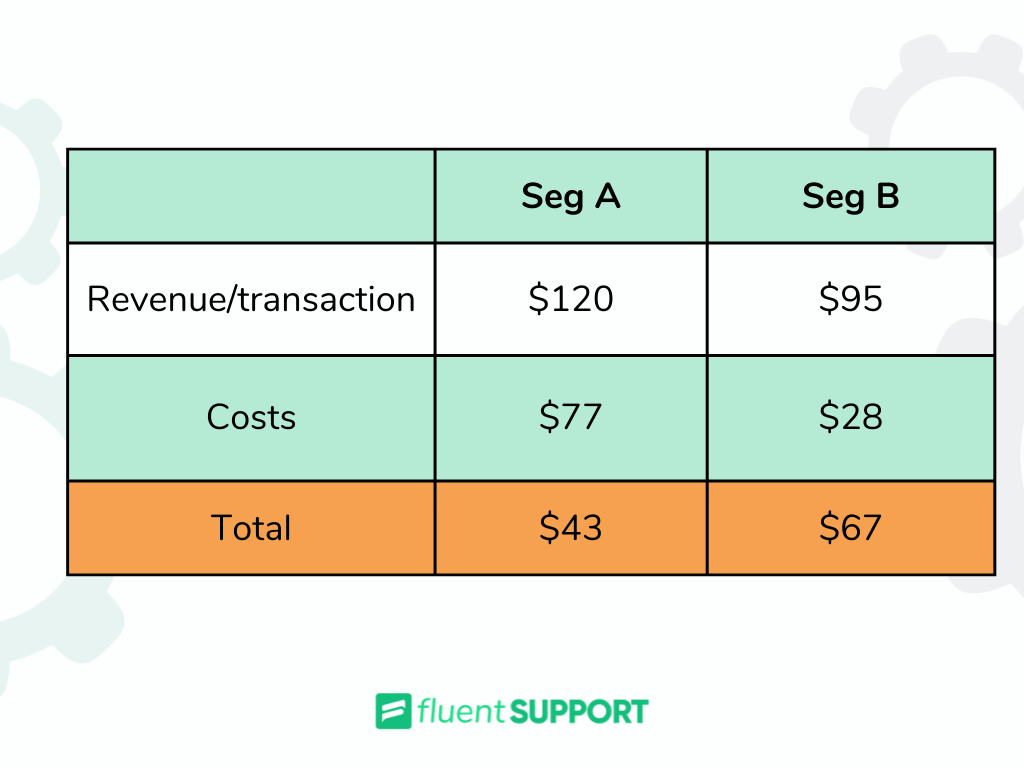

Seg A revenue/purchase = $120

Seg B revenue/purchase = $95

From this, it’s clear Segment A is more profitable. But that changes when you take into account the profitability analysis.

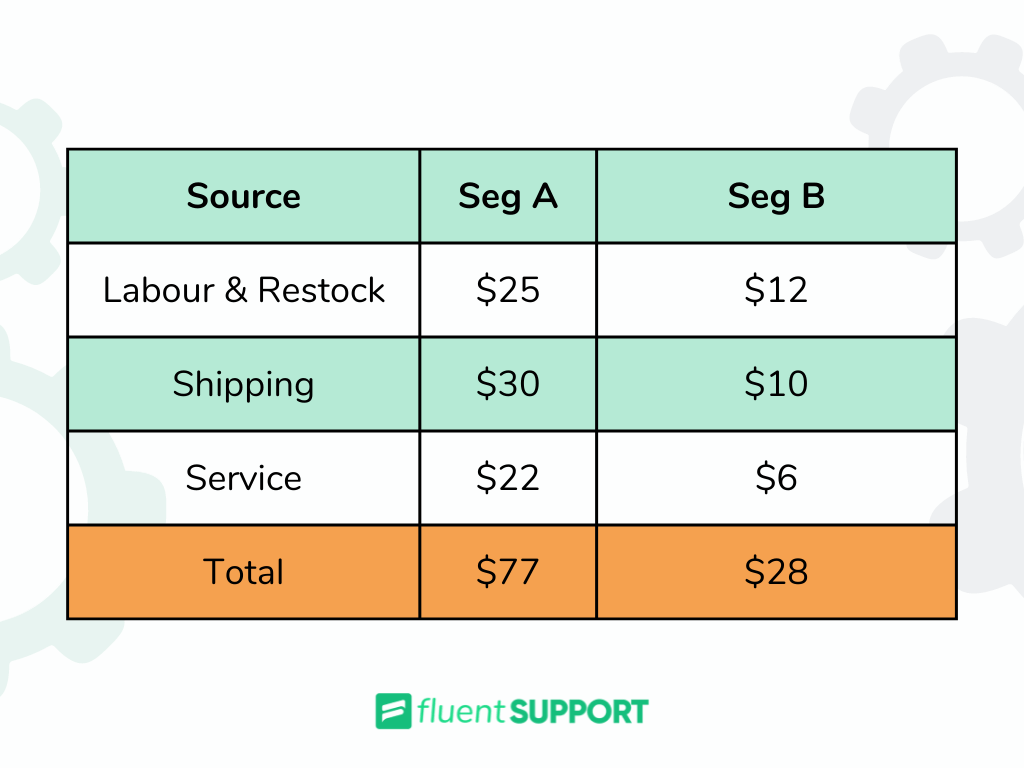

As per the CPA formula, you need to account for hidden costs. Say those costs are as follows,

When you plug in these values in the CPA formula, you get something like this.

This chart makes it clear that although Segment A is generating more revenue, they are actually costing you more money than Segment B.

Based on this, you can effectively decide where you should invest more and where it’s time to stop.

Wrapping Up

The most obvious drawback of Customer Profitability Analysis or CPA is the dependence on a limited time frame. Because of that, customer profitability is calculated using new methods that determine an LTV rather than just the sales within a quarter.

It’s intuitive to think of these metrics as complementary to each other instead of alternatives. We hope the benefits you can get by conducting CPA are clearer for you guys. Let us know what else you’d like to measure to evaluate your business success.

Until next time, happy serving!

Start off with a powerful ticketing system that delivers smooth collaboration right out of the box.

Leave a Reply