Ever wonder why some customers come back to your business again and again? Why are repeat customers the best revenue generator for your business?

It is simple yet one of the most important questions you should ask yourself as a business owner! Acquiring new customers is challenging and expensive. However, retaining existing customers is easy if you precisely calculate the customer lifetime value your business has.

Often called LTV or CLV, Customer Lifetime Value helps you understand the monetary value of a customer. You can learn how profitable your business will be in a certain quarter by understanding your customer’s lifetime value. Customer LTV is an essential metric to learn more about customer retention, churn rate, what marketing tactics are working to acquire new customers, and how much it will cost.

In this blog, we will cover what is customer lifetime value and how you can calculate CLV; get benefit from it by increasing existing customer value.

What is customer lifetime value?

Customer lifetime value (CLV), or lifetime value (LTV) is a customer service metric used widely to discover the potential revenue a business can earn from a single customer throughout the business connection.

When a customer becomes a repeat buyer of a business, customer lifetime value increases exponentially. Companies can predict their future revenue by calculating current customers’ lifetime value. By analyzing the CLV data, businesses can also learn how much it will cost to acquire a new customer.

CLVT metric is highly connected with the customer support team because it can influence customers’ decisions more than any other team. They play a huge role in solving everyday customers’ problems and onboarding customers through their purchase journey. Customer representatives can use this to their advantage and increase customer lifetime value by providing great customer service, reducing customer churn, and increasing customer loyalty, and retention.

Sometimes businesses focus so much on new customers and single sales they push marketing too much and burn cash. But optimizing customer lifetime value and acquiring new customers costs will be reduced significantly. Research done by Frederick Reichheld of Bain & Company (the inventor of the net promoter score) shows that if you try to customer retention rates by 5% business profits will increase by 25% to 95%.

Customer retention is more effective than burning the marketing budget to get new sales. It can be a lifeline for new businesses to get a hold on the ground and win a competitive market.

Why should you calculate customer lifetime value?

Customer lifetime value tells you how much revenue your business can generate from a returning customer. You can use the CLTV metric to evaluate your customer support operation and decide if it is worth the money.

Every team in your business can use the customer LTV metric to optimize their ongoing operation. From the product team to the marketing and sales team, they can use customer lifetime value to gain knowledge about new customer acquisition costs and marketing budget to reach new customers, engage with them, and retain existing customers who are just onboarding through the funnels.

Information like this can make a business profitable or help them create a strategy to become successful. Here are a few reasons a business should calculate their customer’s lifetime value:

- When you have more information about your customers, you can create a persona of your ideal customer. Calculating customer lifetime value will help you understand how much your customers spend on your business and what is the perfect demographic. Then you can target them through advertisement and accurate copywriting, developing a cost-effective customer acquisition strategy.

- Customer loyalty is important to increase brand awareness and organic growth. When your customer lifetime value is low, you can identify the factors contributing to why customers are not coming back. You will know whether you should invest in your customer support team or your marketing team to meet customer needs.

- Increasing customer lifetime value plays a significant factor in increasing revenue. When you identify your most valued customer who spends big on your business, you can segment them into a new group and serve them better. These customers will recognize your effort, become more loyal to your brand, and bring revenue through word-of-mouth marketing.

- Acquiring new customers is five times more costly than retaining existing customers. Then why not focus on retaining your old customers? Identify your most valuable customers using CLTV data and, nurture them, build long-term relationships through customer loyalty programs from time to time. It will help your business to gain high-profit margins, increase customers’ lifetime value and save money on acquiring new customers.

How to calculate customer lifetime value?

Now that we know why your business should calculate customer lifetime value, let’s move on to learning how to calculate customer lifetime value.

To find out your customer LTV, you have to find your average customer lifespan. First, find customer value, calculate your customer’s average purchase value and multiply it by the average number of purchases.

Calculate how much time the average customer spends with your business; that’s your average customer lifespan. Multiply it with average customer value to find your business’s customer lifetime value.

Here is the primary CLTV formula:

Customer Lifetime Value = (Customer Value X Average Customer Lifespan)

Customer Value = Average Purchase Value X Average Number of Purchases

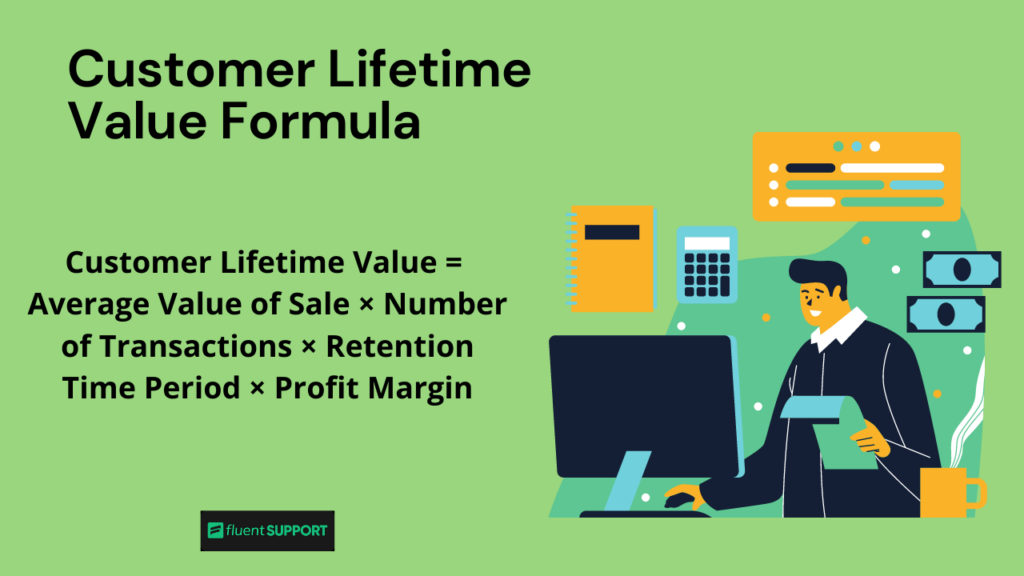

You can also calculate customer LTV using this popular formula:

Customer Lifetime Value = Average Value of Sale × Number of Transactions × Retention Time Period × Profit Margin

It is a more detailed formula to learn more about an average customer. But both work fine.

For example, if you have a product with a $30/ monthly fee, with an average gross margin of 50%, and a new customer acquisition cost of $10 with a 12-month lifespan; your customer lifetime value will be:

CLTV = $30/month x 0.5 x 12 months – $10 = 160

$160 is your average customer lifetime value. The above way is the most used way to calculate a customer LTV.

Customer lifetime models

There are two types of customer LTV companies use for their operation. They are:

Predictive Customer Lifetime Value

If you want to learn your existing customers’ and new customers’ buying patterns, and behaviors and predict what they are going to do, then predictive CLTV is the model you should use. You can use this model to learn more about:

- Who are your most valuable customers

- What products do they buy most

- What problem they are facing in the buying process

- How you can improve the customer onboarding process for new customer

- How you can improve customer retention

Historical Customer Lifetime Value

This model uses your past user’s data without predicting whether your existing customer will do business with you and calculate the value of your customers.

In this model, the average order value is used to determine your customer’s LTV. That’s why historical customer LTV is mainly used when customers interact with your business in a certain quarter.

Although this model is not sustainable, because in this model inactive customers could buy from you in the future, and the model only predicts CLV for a certain period, the data can be manipulative.

Customer lifetime value factors

Many factors play different roles when calculating customer lifetime value. Let’s look into them one by one:

Average Purchase Value

The average purchase value is your every customer transaction. It can be the average value of your customer’s cart or monthly subscription. You can calculate that by finding out the total revenue of your certain business quarter and dividing it by the total number of orders from that time.

Average Gross Margin

Gross margins tell you what your cost is on average customers and the profit. The average gross margin formula is-

Gross Margin = (Total Revenue – Cost of Sales) ÷ (Total Revenue)

Total revenue depends on Gross and Net sales

Average Purchase Frequency Rate

This can be calculated by the number of purchases made by a customer in a certain business quarter. This tells you how much customers spend in a certain period.

Average Purchase Frequency Rate = number of purchases ÷ number of customers

Customer value

Customer value is the average purchase value multiplied by the average purchase frequency rate.

Customer lifespan

These are the most important CLV factors. Customer lifespan plays a massive role in business. You can calculate it by the time customers spend with your company. It means how many times average customers order from you in a certain time.

Average Customer Lifespan = Sum of customers’ lifespan ÷ number of customers

If you want to improve your customer LTV, you need to improve your customer lifespan. Customer retention is essential for that. It often depends on how well your products are and how often you are updating your products. Your customer service team is also vital to retaining customers through excellent service.

Customer Acquisition Cost

CAC tells how much you spend to acquire a new customer. This includes your marketing costs, advertising costs, and everything that goes into running a sales funnel. You can calculate this by dividing the most spending in a certain period by new customers acquired.

Churn rate

When a customer stops doing business with you after a certain period, churn rates go high. You can calculate the churn rate by calculating how many customers you have starting a quarter, how many new customers you acquired in that quarter, and how many customers you lost.

Customer loyalty

Customer loyalty determines how popular a brand is among its competition. If you want to build a brand out of your business, you should focus on building loyalty among your customers.

You can calculate your customer loyalty by calculating customer retention rates and reduced churn rates during a certain period.

How to increase customer lifetime value?

Customers’ lifetime value depends on the above factors we discussed earlier. Business owners can focus on improving these points and invest in customer experience to increase their customer lifetime value.

Here are some tips to increase your business’s customer lifetime value:

1. Optimize customer onboarding

Focus on how a customer first makes their purchase with you. Onboarding means when a new customer first comes into contact with your brand. That could be your business name, website, or store. How your website copy influences them, what product they are ordering for the first time, and how much time is needed from cart to payments, everything matters in the customer onboarding process.

The more seamless it is for customers, the more new customers will stick with your brand. It is also important for customers to get help in one click while onboarding. Train your support agents about your onboarding process, and create a framework to follow with minimal roadblocks!

2. Increase customer order value

Make it easy for your customers to buy more from you. If you are an eCommerce store, suggest to your first-time customers more relevant products while they are on their cart checking out. Show social proof like customer reviews and ratings along with the products.

Amazon does a good job of suggesting related products while a customer is onboarding them for the first time. Increasing just 1% order value will play a huge role in increasing your customer lifetime value.

3. Invest in customer service

Invest in your customer service. Do not treat your customer support team as a small part of your company. Integrate customer support with all teams, from the development team to the sales team. Treat it like the main focus of your company to deliver great service to your customers, no matter if they are new or old.

A bad customer experience can damage your brand in the long term by driving new customer acquisition costs high. Good customer service helps you create brand loyalty, build trust among customers, and increase customer retention. We have already discussed how customer retention is crucial for customer lifetime value.

4. Build a personal connection

It is very easy for brands to build personal relationships with their customers in this social media era. People don’t want to wait for a reply from a business. They want immediate answers. Most times, customers share frustration through social media.

Businesses active in social media can make a proactive approach to connect with customers directly and solve their problems right there. Customers will feel valued and more connected with your brand over time. That’s why every business should have an omnichannel support strategy.

Do not hesitate to reply to negative reviews; your positive action will attract potential customers to your brand. People often recommend brands without buying from them just because they had a great interaction with the brand online. People appreciate it when they feel their voice is heard. Respect your customers, show it through your actions, and customers will reward you with their loyalty.

5. Collect customer feedback

Run surveys and polls in your existing customer base. Ask them how you can improve your services. Often customers are the ones who come up with great solutions. Listen carefully and give credit to the customers who point out your fault.

Use gift cards or discounts to give back to your most engaging customers. This will make them feel respected, and they will feel they are a part of your brand. Meaningful connections like this help evolve your brand from time to time. Focus on building long-lasting relationships.

6. Start a loyalty program

Plan a loyalty program across your business. Surprise your most repeat customers with discounts. You can implement loyalty programs in so many ways. Zappos famously does this by upgrading customers from 6-7 days shipping to 2 days shipping option. This makes customers feel special and talk about it with their friends & family, often sharing their experience as a customer with the world using social media.

You can segment your most valued customers by their average purchase frequency and send them discounts, rewards, or other offers from time to time. It will increase your customer’s lifetime value exponentially.

7. Use retargeting

Retargeting is an advertising tactic to help you retarget your customers through their online presence. It helps you to optimize your advertising budgets. The cost of retaining an existing customer is less than acquiring a new customer.

You can use retargeting to remind existing customers of your brand and increase brand presence online. Re-engaging with customers over time also helps increase the average order value. This contributes to the long-term effect of increasing customer LTV.

Conclusion

Customer lifetime value is a crucial customer metric. It helps you plan your business’s future growth and predict profitability. You can use the CLTV metric to plan your marketing cost, and business expansion, and measure customer service.

Customer LTV helps you learn how much your customers spend, where customer churn is happening, and what it will take to retain your customers. Use this metric to analyze customer data and start making changes to improve your business revenue.

Start off with a powerful ticketing system that delivers smooth collaboration right out of the box.

Leave a Reply